Blog

Predict & Decrypt

Explore the latest blog posts from PredictWise thought leaders & experts.

Notes from the Battlefield: The digital clash of Democrats Vs Republicans

November is just around the corner and campaigns are gearing up for the ad war, with an ever-increasing focus on the digital space. As campaigns start to shift from a fundraising focus to a strategy focused more on persuasion and finally to get-out-the-vote, we should start to see a larger volume of political ads filling up our digital screens.

Ummm What is a Mobile Advertising ID?

You might have heard the word Mobile Ad IDs floating around a lot in digital advertising spaces recently. Mobile Ad IDs have been called by many names: device IDs, MAIDs, unique device IDs, and mobile identifiers, to name a few, but what is it?

Digital Trends Pulse

Here are the top 3 digital trends PredictWise will be keeping an eye on over the next few months:

Political Campaigns Crucial Pivot to Social Media Advertising

Saying that things are normal right now would be a drastic understatement, especially in politics, and even more so in the digital space. We are right in the middle of a very important election, while also dealing with a global pandemic; things could not be more complicated.

Fundamental Model Predicts Electoral College Tie

Today, February 27, 2020, we release our fundamental Electoral College model for 2020. I want to emphasize that I ran the data without knowing what would happen: it comes out as a 269 to 269 tie.

Impeachment: Can we expect more of the change in sentiment we have seen recently?

A lot has been written about the impeachment of President Trump, and the shift in public opinion. For example, the 538 tracker has about a 4 ppt. advantage for support, a massive shift from late September when Don’t support was up by almost 10 percentage points.

Data Journalist Publisher is Unfortunate Pundit

Could not help myself, so my future reference I made a quick list of how Nate Silver is a really great data journalist and publisher, but a really bad pundit and not a progressive.

PredictWise: 20-For-20

Two very different feelings dominated on the morning after the 2016 election: anger/shame/frustration/sadness regarding the State of the Union and a sense of validation, namely that large-scale continuous data collection via disparate modes, paired with the right analytics, can yield actionable insights able to help us dissect the American mindscape.

Misinformation has a Republican bias. The question is: why?

Republicans and President Trump have been engaging in full-blown misinformation campaigns for years now – everything from crowd-sizes at Trump speeches to illegal immigrants voting to promises of universal coverage and rhetoric around a stronger healthcare amidst dropping numbers of insured.

The Atlantic's The Geography of Partisan Prejudice: Post Scriptum

When we were approached by The Atlantic in early 2018, we developed a bold idea together. Develop a map (both geospatial and geographic) of what we as researchers call affective polarization or political tolerance.

The Atlantic's The Geography of Partisan Prejudice: Method Addendum

Today, The Atlantic published a story identifying the least and most politically tolerant counties in the US and along the way ranking every county on a political tolerance scale, using analytics by PredictWise.

PredictWise Segmentation & Audiences Technology

Targeting advertising on the basis of individual-level segmentations is not a new idea: other organizations have collected custom survey data – time- and cost-intensive, to create static segmentation of persuadable, as a one-size-fits-all solution for digital targeting of the entire campaign. PredictWise offers a radically different approach.

Mainstream Media's Bad Incentives

If the mainstream media sees details of a policy, it will tear it apart. But, if it does not see details of a policy, it will take its supporter’s word for what it does, even if it is impossible and otherwise absurd in the context of the supporter.

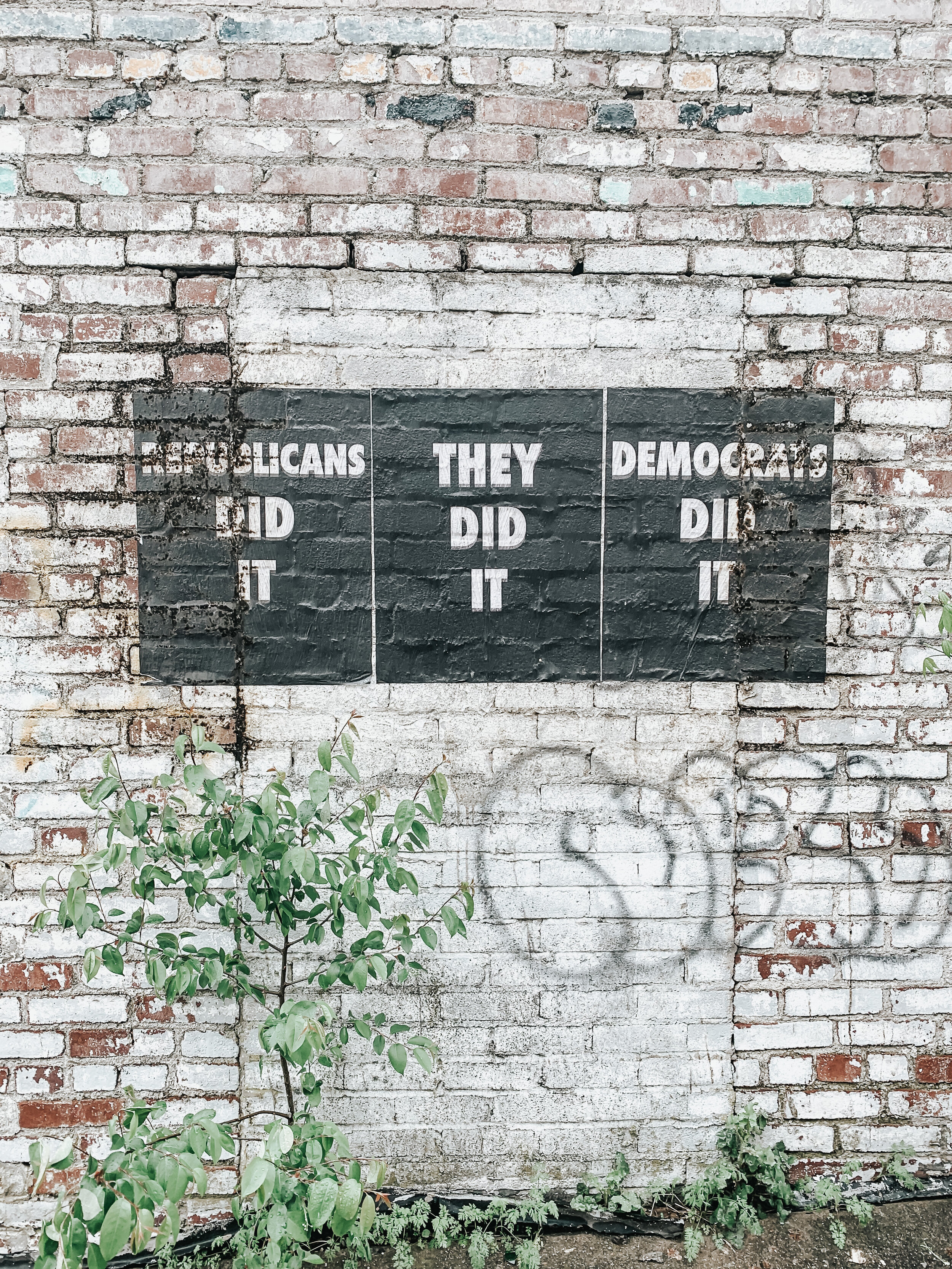

False Equivalency, False Legitimacy, Asymmetric Accountability

There are two ways to gain legitimacy as a news organization covering US politics (1) be objective or (2) be balanced. Objective means that if one side is right and the other side is wrong, the reporter makes that clear in the article. But, that means making hard calls, and backing it up with detailed evidence.

Republicans Hate the Constitution

This is an update to a piece I wrote in early 2018. Republicans, media, and sadly Democrats all seem to believe that Republicans are into the Constitution. But, they are not: Republicans hate the Constitution.

Trump and Russia

President Trump is compromised to Russia. Russia knows a lot of secrets about both his business and political dealings which, if revealed by Russia, would/should cost Trump (and his family) politically, financially, and possibly criminally.

Jewish Americans are American

Antisemites think they have Jewish-Americans in a tight spot. When a Jewish American says something about opposing an ethno-nationalist state in America, they retort: what about Israel! They have an ethno-nationalist government! Do you think they should have open-borders?!?

Calibrated polling: Post-Mortem

Late in the cycle, we introduced a new method we dubbed PredictWise Calibrated Polling. As a brief reminder, this is Calibrated Polling: As we have maintained through the cycle, estimating who people will vote for, conditional on them turning out, was easier than estimating the composition of the turnout composition of the electorate.

Three late polls, and more lofty thoughts

We have launched three late-breaking polls into interesting and critical races, Nevada Senate, Texas Senate, and CA-22 – all polls make use of our newly developed method, Calibrated Polling, making use of live-updating early voting data to calibrate our expectations of the turnout space.

Real Data & Real Solutions

PredictWise offers solutions for all data needs with experts in retail, E-Commerce, politics, non profits & much more. PredictWise services & products are all custom tailored to your campaigns needs, no matter your goal. Create customized audience segments leveraging real people-based data, not anonymous cookies.